After we talk about insurance alternatives, we’re diving right into a world that most of us would rather keep away from serious about, appropriate? In the end, insurance plan isn’t exactly the most fun topic, but it’s crucial. Why? Due to the fact everyday living is unpredictable, and having a dependable basic safety Web may be the distinction between a smooth Restoration as well as a catastrophic setback. So, what precisely is definitely an insurance Alternative, and why do you have to care?

Allow’s get started with the basic principles. An insurance plan Answer is a lot more than simply a coverage or even a piece of paper. It’s a method created to assistance guard persons, families, businesses, and assets in opposition to unpredicted dangers. These threats may very well be everything from health emergencies to incidents, property damage, as well as lawful troubles. At its Main, insurance policies provides money protection by encouraging you control the cost of these unforeseen occasions.

Rumored Buzz on Insurance Solution

But below’s the point: insurance plan isn’t a 1-dimension-matches-all Resolution. That’s exactly where insurance policies solutions appear into Participate in. Imagine it like picking out the ideal tool for the position. Just as you wouldn’t use a hammer to screw within a lightbulb, you shouldn’t rely upon generic insurance coverage policies when your requirements are unique. Insurance methods are personalized towards your distinctive situations, ensuring which you obtain the coverage you need with out paying for Whatever you don’t.

But below’s the point: insurance plan isn’t a 1-dimension-matches-all Resolution. That’s exactly where insurance policies solutions appear into Participate in. Imagine it like picking out the ideal tool for the position. Just as you wouldn’t use a hammer to screw within a lightbulb, you shouldn’t rely upon generic insurance coverage policies when your requirements are unique. Insurance methods are personalized towards your distinctive situations, ensuring which you obtain the coverage you need with out paying for Whatever you don’t.One example is, Allow’s say you’re a little business owner. Your insurance Answer could possibly glimpse various from a person who performs a nine-to-5 job. Although the two of you could require well being insurance plan, the business enterprise operator may additionally have to have coverage for such things as legal responsibility, property destruction, or maybe business interruption. This is where the concept of tailored insurance coverage options shines.

One more vital facet of coverage solutions is overall flexibility. Life doesn’t remain the identical, and neither do your coverage requirements. When you grow old, your priorities change. You would possibly purchase a dwelling, begin a relatives, or launch a whole new small business. Using a dynamic insurance policy solution, your protection can evolve right coupled with you, guaranteeing you’re usually guarded—no matter what daily life throws your way.

Now, let’s look at the types of insurance coverage alternatives you can take a look at. There's a chance you're accustomed to the basics—health and fitness insurance policy, auto insurance policies, home insurance—but Do you know there are lots of extra options readily available? For example, life insurance coverage, incapacity insurance policies, pet insurance policies, and in some cases cyber insurance are getting to be ever more common. The purpose is, there’s a solution for nearly every aspect of lifetime. You just really have to know where to glimpse and what suits your preferences.

So, why is it so crucial to check out diverse insurance coverage solutions? It’s straightforward: the more you know, the greater you'll be able to secure you. Insurance could be a maze of jargon, hidden costs, and good print. But if you understand the alternatives accessible to you, you’re in an improved posture to generate educated decisions that save you funds and pressure down the road.

One of the most frequent worries people today experience when considering insurance policies alternatives is comprehension the terminology. Text like deductible, high quality, and copay can seem like a foreign language. But don’t fret; once you crack it down, everything begins to make sense. Let’s say your high quality is the quantity you pay out in your coverage, as well as your deductible is exactly what You need to shell out outside of pocket in advance of your insurance policy kicks in. The key is to find a harmony in between these variables that works to your funds and your requirements.

All about Insurance Solution

Another reason people generally stay clear of insurance plan could be the concern of overpaying. It’s easy to fall into the lure of assuming that the additional you spend, the better the coverage. But that’s not always the case. The ideal insurance policy Alternative is 1 that gives the ideal protection at a good value. Keep in mind, the cheapest solution isn’t often the best, but the most costly isn’t automatically the most complete Discover more both.When assessing insurance coverage alternatives, it’s crucial to check with concerns. What’s included? What’s not? Are there exclusions? How will my requires adjust in the next five or a decade? These questions can help you understand the entire scope of your coverage and ensure you’re not remaining unprotected in the event the unanticipated occurs.

One of the rising traits inside the insurance policies environment would be the increase of digital platforms and apps that offer personalised insurance plan methods. Long gone are the days of paying hrs within the phone using an agent or sitting in a very waiting around area. Now, you can certainly Examine procedures, get offers, and also handle your coverage with only a few faucets with your cellular phone. This benefit is earning insurance policy much more available than ever, but In addition it implies you should be additional careful about the options you decide on.

After you’re searching for the ideal insurance policy Remedy, it’s handy to work with an experienced—no matter whether it’s an insurance plan broker, agent, or specialist. These professionals may help you navigate the options, clarify the fantastic print, and make certain that you don’t pass See details up out on significant protection. In fact, insurance coverage isn’t nearly buying a policy; it’s about buying satisfaction.

For people, insurance policies methods frequently suggest a combination of different policies. Wellbeing, everyday living, property, and automobile insurance are only the start. When you have kids or dependents, you might want to think about more protection, for instance a university financial savings prepare or prolonged-phrase treatment insurance coverage. The aim is to make a security Internet that spans each Section of your life, so that you can rest uncomplicated knowing that your loved ones are safeguarded.

The Facts About Insurance Solution Revealed

For enterprises, the proper insurance coverage Alternative is essential to extended-time period accomplishment. With no good protection, even a insignificant oversight or incident could lead on to fiscal catastrophe. From liability insurance plan to house and worker’s payment, businesses want to ensure that their risks are managed proficiently. A reliable insurance policy Option could be the distinction between thriving in the competitive industry and closing your doorways for good.

One area where by insurance policies methods are becoming progressively critical is inside the realm of electronic stability. Cyber insurance policy is a relatively new type of protection that shields businesses from on the net threats, for instance details breaches, hacking, and cyberattacks. In an age exactly where Pretty much every little thing is on the web, obtaining the best insurance policy Option to safeguard in opposition to these risks is a lot more critical than in the past.

Now, Permit’s look at statements. When you should use your insurance policy, it’s crucial that you know the way the procedure functions. Submitting a claim could be a Check it out demanding knowledge, particularly when you’re not acquainted with the ways included. That’s why comprehension your insurance plan Remedy beforehand is essential. The better you understand your policy, the easier It'll be to navigate the statements course of action and have the help you require when factors go Incorrect.

At the end of the day, the goal of an insurance policy Remedy is simple: to offer economic safety and peace of mind. Life is usually messy, unpredictable, and downright too much to handle at times. But with the proper insurance policy Resolution set up, you’re superior Geared up to take care of whichever arrives your way. No matter if you’re defending your overall health, your home, your company, or All your family members, insurance helps you regulate chance and navigate life’s uncertainties with self esteem.

In conclusion, choosing the suitable insurance policy Remedy is a process that requires assumed, investigation, and setting up. It’s not pretty much picking the main coverage you stumble upon or going for the cheapest selection. It’s about knowing your special demands, evaluating your options, and picking an answer that fits your life today—and in the future. By doing so, you'll be able to make certain that regardless of what takes place, you’ll Use a money protection Web to tumble back again on.

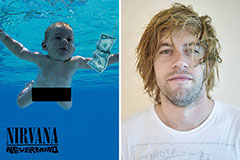

Spencer Elden Then & Now!

Spencer Elden Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!